Export of Bio Made in Italy: the record of Scandinavian Europe.

Did you know that Organic Made in Italy is the most popular product for four out of ten Scandinavian consumers?

Italy is the country of agribusiness: this is nothing new since, according to SACE, this sector stands as the leading manufacturing sector in Italy, with more than 55,000 companies active in the field. But that's not all: in the last 10 years, Made in Italy organic exports have literally exploded (+181%), making Italy the leading Bio food exporter internationally after the USA. Not only that: in 2022 the export of Organic Made in Italy products reached 3.4 billion euros, registering a growth of +16% considering the previous 12 months.

But which organic Made in Italy products have the largest export share? Of these 3.4 billion euros, food accounts for the bulk, worth 2.7 billion euros. But also relevant is the role of wine, which weighs in at 20% of the remaining Bio Made in Italy exports, and that is a much larger share than with agribusiness exports in general, where the incidence of wine is only 13%. In numerical terms, we are talking about 626 million euros of organic wine Made in Italy sold in international markets, registering a +18% compared with 2021.

The potential of organic Made in Italy exports

Already in the article devoted to the’Made in Italy pasta exports to the U.S. we were talking about how for the Italian food sector, the future holds great business opportunities. And even in the case of organic food, great growth is expected in the coming years: 30% of European consumers say they are interested in buying an Italian food product with an organic brand name, share rising to 46% with regard to wine.

The undecided would be attracted not only by promotions and low prices but also by famous brands, information on low environmental impact, and the presence of eco-friendly packaging. More than half of current non-wine users, in fact, have not yet tried Italian organic because they cannot find it in the assortment, while in 1 in 5 cases they do not yet know its distinctive characteristics. The same reasons for non-purchase also apply to food products: 26% of those who do not consume Made in Italy organic food say they do not know its distinctive characteristics and, in 1 case out of 10, they do not find it in their regular outlets.

Which markets to focus on? Scandinavian Europe in first place

In recent weeks we have reported how exports are an indispensable driving factor For Italian companies that want to Overcoming critical issues in the domestic market. Octagona presented numerous insights on business opportunities abroad for Italian companies, speaking for example about the’export to the United Arab Emirates or of How to export to Germany and ride the new golden moment of Made in Italy export in the German market.

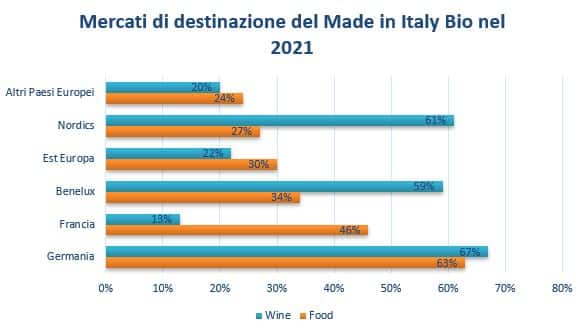

From the survey conducted between July and August 2022 by Nomisma for ICE Agency and FederBio on a sample of 290 Italian food and wine enterprises, it emerged how the main destinations in Europe for Italian organic food are Germany (indicated overall by 63% of the companies) and followed by. France (46%) and Benelux (34%). For the wine still leading the way is the German market (67%), followed at a very short distance by the Scandinavian countries (61%)-where, always, the appreciation of organic wine is very high-and from the Benelux (59%). Outside the borders of the EU, the following take the lead. Switzerland, United States and the United Kingdom for both food and wine.

The data thus confirm a strong interest in organic in Scandinavia: nearly 9 out of 10 households consumed an organic-branded food product during 2022. Other factors that make Scandinavia a high-potential market include the percentage of regular consumers (more than 40% of Scandinavian consumers buy organic in every grocery shopping trip) and the importance of the organic brand, so much so that 1 in 5 consumers say they place it first in their choice when purchasing food products.

And how is Italy positioned in relation to Scandinavian Europe? In the imagination of Danish consumers, Italy ranks first among the countries that produce the highest quality Organic products: that is the 38% of consumers think so, thus almost 4 out of 10.

In the case of Sweden, our country contends for the lead with Denmark: in that case, the share of users pointing to Italy when they think of the highest quality organic products is 37%. Further confirming the excellent reputation of Italian organic, For as many as 6 out of 10 Scandinavian consumers, organic food products made in Italy have superior quality compared to products from other countries while for 7 consumers 10 Italian organic has a higher perceived also in terms of guarantees of traceability and environmentally friendly production methods. Thanks to this excellent perception, Italian organic products find wide diffusion in Scandinavia: 65% of households bought an organic-branded Made in Italy food product during 2022 and 30% bought them at least once a week.

But what are the most promising products for Bio Made in Italy exports? Extra virgin olive oil, cheeses, tomato preserves, cured meats, cheeses and wine are the Italian organic branded products most purchased by Scandinavian consumers but also the categories for which consumers are most interested in the organic-Made in Italy combination.

Conclusions on Bio Made in Italy export

Thanks to this excellent perception, Italian organic products find wide acceptance in Scandinavia, as these are foods that combine attention to sustainability with the high quality of Italian agrifood production, incorporating cultural, social and environmental values recognized and appreciated worldwide. La product quality And the general interest of foreign consumers in Made in Italy products are our bio's calling card in international markets. High average per capita spending on organic products and the guarantees associated with organic agri-food products are also considered elements of success.

And looking ahead, according to analysts, Scandinavian Europe. will remain the favorite market for Italian agribusiness in the coming years.

ALSO READ:

The 3 Trends of 2023 on Digital Export

Where to export despite global tensions? The most dynamic countries in 2023

Made in Italy exports: food leads the recovery